Who was Harshad Mehta?

Harshad Mehta, born in 1954 in Gujarat, India, emerged as a leading figure in the Indian financial markets in the late 1980s and early 1990s. He earned the moniker “Big Bull” for his bold and aggressive trading strategies that propelled him to fame in the stockbroking community. Mehta’s career trajectory was marked by meteoric success and subsequent controversy, making him a polarizing figure in India’s financial history.

Harshad Mehta Scam: Explained

The Harshad Mehta scam, also known as the Securities Scam of 1992, is one of the most notorious financial frauds in India. Mehta took advantage of loopholes in the banking system to manipulate stock prices, particularly in the Bombay Stock Exchange (BSE). His method involved using funds from banks to artificially inflate stock prices, creating a “boom and bust” cycle that eventually destabilized the market. The scam led to widespread investor panic, regulatory reforms, and profoundly influenced how financial transactions are monitored in India today.

Impact of Harshad Mehta on Indian Stock Market

Harshad Mehta’s impact on the Indian stock market was profound and multifaceted. His ability to manipulate stock prices temporarily boosted market indices, attracting millions of investors who were lured by the promise of quick returns. However, the scandal exposed weaknesses in India’s financial sector, resulting in a loss of investor confidence and a significant market downturn. This in turn prompted the regulatory authorities to implement stringent measures and reforms to prevent similar abuses in the future, reshaping the Indian financial governance landscape.

Biography of Harshad Mehta

Harshad Mehta’s early life was marked by humble beginnings in a middle-class family in Gujarat. His career began as a small-time broker in the 1970s, gradually rising through the ranks through his shrewd understanding of the market and trading strategy. Despite his controversial ways, Mehta was respected for his financial acumen and ability to navigate the intricacies of stock trading. His rise to fame culminated in a tragic fall amid legal battles and public scrutiny, casting a shadow over his once-glowing reputation.

Harshad Mehta Family

Harshad Mehta belonged to a close-knit family deeply rooted in the cultural fabric of Gujarat. While his professional achievements grabbed the headlines, his family remained a steadfast support system during his tumultuous career and subsequent legal troubles. Their resilience and solidarity in the face of adversity underscored these personal challenges amid the public fallout from the scandal.

Harshad Mehta Son

Harshad Mehta’s son, Attur Mehta has maintained a low profile despite his father’s controversial legacy. Unlike his father, Attur Mehta chose to stay out of the limelight, focusing on keeping a private life away from the media scrutiny that surrounded his family during the tumultuous years. Her decision reflects a desire for privacy and detachment from the controversies that defined her father’s career.

Harshad Mehta Movie

Harshad Mehta’s life story and infamous securities scam have been immortalized in various forms of media, including books, documentaries and adaptations. However, the most notable image came through the web series “Scheme 1992: The Harshad Mehta Story”, which captivated audiences with its meticulous depiction of Mehta’s rise, fall and complex dynamics of the financial world. The series won widespread acclaim for its meticulous attention to detail and portrayal of the events that shaped India’s financial history.

Harshad Mehta Death: The End of a Controversial Legacy

Harshad Mehta, once hailed as the “Big Bull” of the Indian stock market, met his demise on December 31, 2001, at the age of 47. His death marked the conclusion of a tumultuous journey that had captivated the nation and left an indelible mark on India’s financial history.

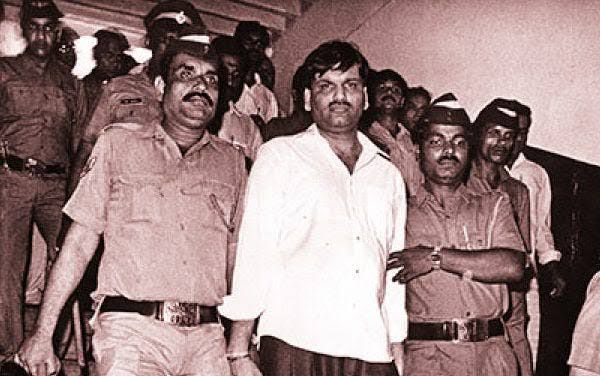

Circumstances Surrounding Harshad Mehta’s Death

Harshad Mehta passed away due to cardiac arrest in Thane, Maharashtra, while undergoing trial for his involvement in the securities scam of 1992. His sudden death shocked many, coming at a time when he was grappling with legal battles and the aftermath of his controversial financial practices.

Harshad Mehta's Net Worth: A Tale of Ambition, Wealth, and Scandal

In the world of finance and scandal, few names resonate as powerfully as Harshad Mehta. Known for his meteoric rise and equally dramatic fall, Mehta’s story is not just about numbers but about the highs and lows of ambition and the volatility of fortune.

Today, let’s delve into the enigmatic world of Harshad Mehta’s net worth, exploring how he amassed his wealth, the scandal that brought him down, and what his legacy teaches us about the nature of success and failure.

So, how did Mehta build such an impressive fortune? His strategies involved a combination of market manipulation, insider trading, and leveraging his connections to gain access to crucial financial information. He was known for his ability to drive up stock prices through sheer force of will and, often, through questionable means.

One of the key aspects of his wealth was his role in the 1992 Indian stock market scam, which involved a massive misappropriation of funds. Mehta exploited loopholes in the banking system and engaged in fraudulent activities to manipulate stock prices and gain huge profits. At its peak, Mehta’s wealth was estimated to be around $2 billion, a testament to his financial prowess, albeit achieved through unethical practices.

Impact and Legacy

Mehta’s death brought an abrupt end to a life characterized by ambition, controversy, and financial prowess. While his methods were debated and scrutinized, his legacy remains intertwined with the evolution of India’s financial markets. The repercussions of his actions reverberated through regulatory reforms and heightened vigilance in the financial sector, shaping policies that aimed to prevent similar incidents in the future.

- You might be interested in reading this post as well

- Justin Bieber